What was good for copper was good for Chile’s peso. The fortunes of the currency of the world’s largest copper exporter were closely tied to the price of its main export.

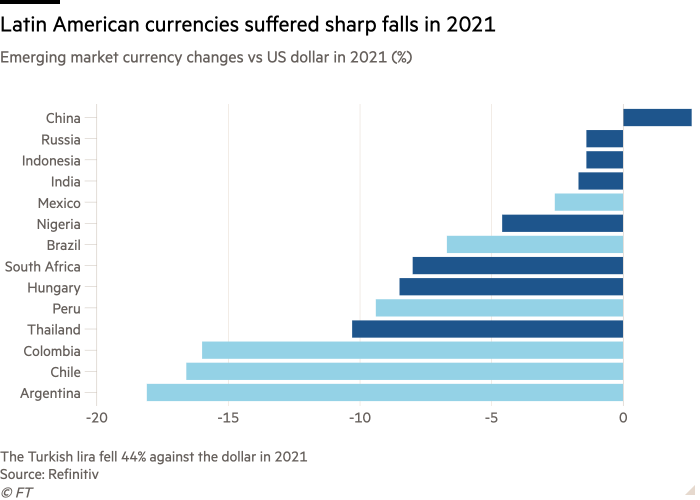

Last year the pattern broke. World copper prices rose 25 per cent in 2021, but the Chilean peso’s value crashed by nearly 17 per cent against the US dollar — one of the worst performances by any major emerging market currency.

Chile’s experience was not unusual. Despite a strong global rise in commodity prices last year, the currencies of all major Latin American economies weakened, some dramatically.

The Colombian peso lost 16 per cent of its value against the dollar, while the Peruvian sol weakened by more than 9 per cent. Brazil’s real suffered its fifth consecutive year of devaluation, losing nearly 7 per cent.

Economists say the striking divergence — unprecedented in recent years — points to a deep sickness in Latin America’s economies.

“It’s very bad news,” said Ernesto Revilla, chief Latin America economist at Citi. “This shows the region is coming out of the pandemic with deeper structural damage than we thought.”

The pandemic’s combined impact on Latin America’s people and economies was greater than in any other region in 2020. After a struggle to procure vaccines early last year, most Latin American governments managed to buy sufficient stocks during 2021 and the region ended the year as the world’s most vaccinated.

However, while the most serious health effects of the pandemic are fading, the economic damage looks much longer-lasting. Latin America was already the emerging world’s slowest-growing region before the pandemic, managing just 0.9 per cent year-on-year increases in GDP on average from 2014 to 2019, according to Goldman Sachs data.

Now, despite higher commodity prices, it risks settling back into mediocre growth, this time with fresh problems: extra debt taken on during the pandemic, rapidly rising inflation and much greater political…